IDeA CCR II Shipping Fund, sells a fleet of 6 vessels to the Montanari Group

IDeA CCR II Shipping Fund, managed by DeA Capital Alternative Funds SGR, sells a fleet of 6 vessels to the Montanari Group based in Fano, Italy.

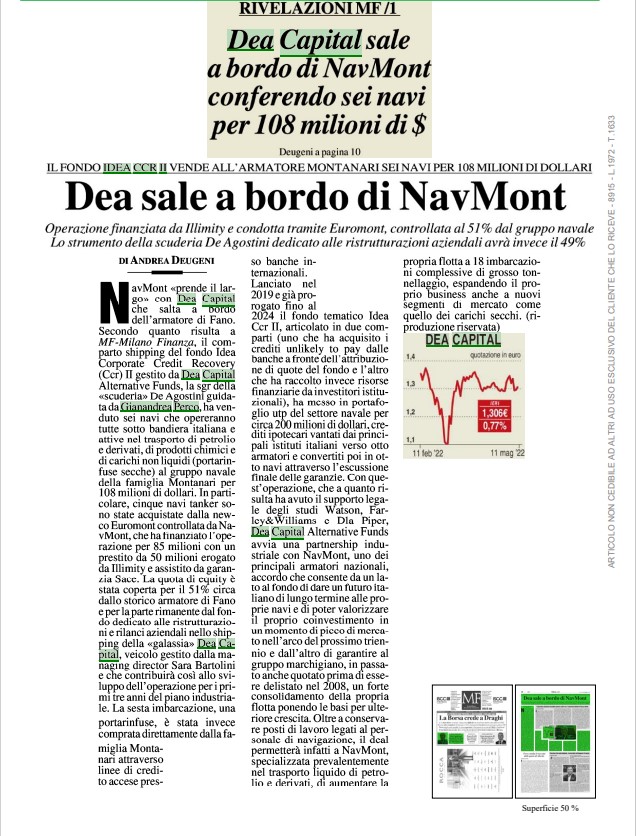

Total consideration: $108 million

Milan, May 12, 2022

The Shipping Fund of the IDeA CCR II, managed by DeA Capital Alternative Funds SGR, has defined the sale of 6 vessels, operating under Italian flag and active in the oil, product, chemical tankers and bulkers segments, to the NavMont Group, for a total consideration of approximately $ 108 million.

In particular, five tanker ships are purchased by Euromont S.p.A. controlled by NavMont Group, financing the price of $ 85 million with a loan provided by Illimity Bank and Solution Bank backed by a SACE guarantee (totalling approximately $ 50 million). NavMont Group covers about 51% of the equity share whilst IDeA CCR II Fund will contribute the remainder 49%, supporting the first 3 years of the business plan.

The bulker ship will be purchased directly by the NavMont Group, supported by international lenders.

NavMont Group, headquartered in Fano, was founded in 1889 and is fully owned by the Montanari family. Corrado A. Montanari is the President and Fabio the CEO. The Group manages a fleet of 18 oil / product tankers for a gross tonnage of approximately 1m DWT.

With this transaction, IDeA CCR II Fund starts a partnership with NavMont, the historic Italian ship owner giving its ships a long-term Italian future. At the same time, the agreement guarantees the ship owner a strong consolidation of its fleet, laying the foundations for further growth.

The activity of the Shipping Fund of the IDeA CCR II began at the beginning of 2019, following the acquisition of a portfolio of shipping loans worth approximately $200 million towards eight Italian ship owners.

The Fund was launched with the aim of supporting the Italian banking system in the management its Non-Performing Exposures towards a sector characterized by high concentration and, at the same time, to preserve the value of assets that are crucial for the Italian armament avoiding forced liquidations driven by speculative activities.

Following its 3 years of activity, the Fund has closed 7 restructuring, recovering almost all of the loans granted. It manages a fleet of 7 ships with an average age of 11, has carried out 3 exits and has already distributed a significant amount of capital to its investors.The Managing Director of the IDeA CCR II Fund, Sara Bertolini, comments on the transaction as follows:

“The Fund has found in NavMont the “sector champion” whom to entrust the result of our last years work. We are confident that this partnership will be able to secure the fleet owned and managed by the Fund so far and to build on some selected management skills and commercial relations that we bring in the venture”.

NavMont Group CEO Fabio Montanari says: “The purchase of the fleet managed by the IDeA CCR II Fund will allow us to consolidate our presence in the shipping sector and lay solid foundations to open up to new market segments, consistent with the trends of the sector. We are pleased that the Fund will support us for a few years and we are sure that they will be a financial partner with a full understanding of the dynamics of shipping”.

WF&W and DLA assisted the Parties in this transaction.